-

How Investment Firms Work

Wow, Friday is here already! Today’s article is on a topic I get asked about at pretty much every client meeting – how do Investment firms work and do what they look for in a business seeking funding? I hope this article helps to ‘lift the hood’ a bit on what is a pretty complex subject.

What is an Investment Firm?

An investment firm is a company that pools money from investors to provide funding for businesses in exchange for a potential return. They invest in companies with the expectation that their money will grow over time. Some firms focus on startups, while others invest in more established businesses looking to expand.

Investment firms vary in size, from small boutique firms specializing in niche industries to large global institutions managing billions in assets. Regardless of their size, their goal remains the same: to invest in promising businesses and generate a profit through their success.

Types of Investment Firms

Investment firms come in different forms, each with its own way of operating:

- Venture Capital (VC) Firms – Invest in early-stage, high-growth startups, often in the technology or innovation sector. They take on high risk but aim for high rewards by backing disruptive businesses.

- Private Equity (PE) Firms – Invest in more mature companies, often helping restructure or scale them before selling for a profit. They may buy entire companies, optimize their operations, and sell them at a higher valuation.

- Angel Investors – Wealthy individuals who provide early funding for startups in exchange for equity. They often offer mentorship and industry connections in addition to capital.

- Hedge Funds – Invest in a variety of assets, including businesses, but often focus on short-term gains using high-risk strategies.

- Family Offices – Private investment firms managing the wealth of high-net-worth families, often investing in businesses aligned with their long-term interests.

Understanding the type of investment firm that suits your business stage and needs is crucial before seeking funding.

How Investment Firms Choose Companies

Investment firms don’t just hand out money to any business. They have a structured process to evaluate potential investments. This typically includes:

- Identifying Opportunities – Firms look for businesses with high growth potential, strong leadership, and a scalable business model. Many firms specialize in specific industries and seek companies that align with their expertise.

- Due Diligence – A deep dive into the company’s financials, operations, market potential, risks, and potential returns. Investors assess past performance, revenue streams, competitive landscape, and any liabilities before making a decision.

- Negotiation & Deal Structuring – The firm decides how much to invest, the percentage of ownership they will receive, and any conditions tied to the investment. This may involve board seats, voting rights, or performance milestones.

- Providing Funding & Support – Once invested, firms may provide mentorship, strategic advice, and operational improvements. Many firms have networks of advisors and industry experts to help businesses scale quickly.

- Exit Strategy – Investment firms aim to make a return by eventually selling their stake, either through an IPO, acquisition, or private sale. The timeline for this exit can range from a few years to a decade.

What Investment Firms Look for in a Business

If you’re a company owner seeking investment, here are the key things investors typically look for:

- Scalability – Can your business grow rapidly and reach new markets without significantly increasing costs?

- Strong Leadership – Investors back people as much as they back ideas. A capable and experienced management team is a must.

- Financial Health – Clear revenue potential and a solid business model with sustainable profit margins.

- Competitive Advantage – What makes your business stand out in the market? Unique products, patents, or strong brand positioning are key factors.

- Clear Exit Strategy – A path for investors to eventually sell their stake for a profit. Investors need to see a realistic and well-thought-out plan for their returns.

How Businesses Benefit from Investment Firms

- Access to Capital – Enables expansion, hiring, product development, and marketing efforts.

- Strategic Guidance – Investors bring valuable expertise, industry knowledge, and connections to support business growth.

- Credibility Boost – Having investment backing increases trust from other investors, partners, and customers.

- Operational Improvements – Many firms help businesses streamline operations, implement technology solutions, and optimize growth strategies.

- Risk Sharing – Instead of relying solely on debt financing, investment allows businesses to share the financial risk with investors.

Investment firms also provide networking opportunities, giving business owners access to other entrepreneurs, potential clients, and strategic partners.

Understanding the Risks

While investment firms can be a game-changer for your business, there are potential downsides to consider:

- Loss of Control – Investors may take a significant stake in your company and influence decision-making.

- Pressure for Growth – Investors expect high returns, which can put pressure on scaling quickly and hitting aggressive revenue targets.

- Exit Expectations – Investors will eventually want to sell their share, which could impact long-term business plans.

- Equity Dilution – Giving up a percentage of your company means future profits are shared with investors, reducing ownership stake over time.

It’s essential to align with investors who share your vision and long-term goals to avoid conflicts down the line.

How to Attract Investment for Your Business

If you’re looking to secure funding, here are steps to make your business attractive to investors:

- Develop a Strong Business Plan – Outline your market opportunity, revenue model, competitive advantage, and financial projections.

- Build a Solid Team – Investors prioritize teams that have experience and a track record of execution.

- Demonstrate Traction – Show evidence of growth, customer acquisition, and market demand.

- Get Your Financials in Order – Clear accounting records and financial forecasts are critical.

- Network with the Right Investors – Engage with investors who specialize in your industry and stage of business.

- Perfect Your Pitch – Be ready to present a compelling case for why your business is a great investment opportunity.

Final Thoughts

Investment firms are a powerful tool for business growth, but understanding how they operate is crucial before seeking funding. By knowing what investors look for and how they work, company owners can make informed decisions about whether investment is the right path for their business.

If you’re considering investment, take time to prepare—fine-tune your business model, strengthen your financials, and develop a compelling growth strategy. The more prepared you are, the better your chances of securing the right investment partnership for your company’s future success.

Ultimately, investment isn’t just about securing funds—it’s about finding the right strategic partner to help take your business to the next level.

#Investment #BusinessGrowth #Funding #VentureCapital #PrivateEquity #AngelInvestors #Startups #ScaleUp #BusinessFinance #Entrepreneurship #InvestorRelations #BusinessExpansion #SMEs #StrategicInvestment #FinancialGrowth

-

A ‘Helicopter view’ of UK Start-ups and SMEs

The United Kingdom’s start-up and small and medium-sized enterprise (SME) landscape has experienced notable shifts in recent years, influenced by economic conditions, investment patterns, and support mechanisms. This article delves into current success and failure rates, explores investment and incubator options, and offers future forecasts for these vital sectors of the UK economy.

Current Success and Failure Rates

Start-ups and SMEs form the backbone of the UK economy, accounting for approximately 99.9% of businesses and employing over 16 million people. However, their survival rates vary significantly depending on sector, location, and funding access.

Business Birth and Death Rates

In 2023, the UK witnessed the slowest rate of new business creation since 2010, with only 316,000 new businesses formed, down from 337,000 in 2022. This decline reduced the ‘business birth rate’ to 11.0%. Conversely, the ‘business death rate’ also fell, with 309,000 closures, down from 349,000, bringing it to 10.8%. Economists express concern over these trends, as reduced business dynamism can hinder productivity growth and long-term improvements in living standards.

Despite these challenges, there was an increase in ‘high-growth’ employers, defined as businesses with at least 10 employees and a 20% annual staff growth over three years. This segment reached a five-year high of 4.7% in 2023, showcasing resilience among certain start-ups and SMEs.

Start-up Failure Rates

Data from 2024 reveals that the failure rate of new businesses relative to total insolvencies was at its lowest level in over a decade. Start-ups accounted for 46% of total company insolvencies, a significant decrease from the decade average of 60%. This trend suggests improved resilience among new businesses, possibly due to better access to support programmes and more prudent financial management.

However, survival rates continue to be sector-dependent. Businesses in fintech, artificial intelligence (AI), and green technology are showing higher resilience, while retail and hospitality ventures struggle due to changing consumer behaviour and inflationary pressures.

Investment and Incubator Options

The UK offers a robust ecosystem for start-ups and SMEs seeking investment and support. Government initiatives, venture capital, and private incubators play a crucial role in nurturing new businesses.

Government-backed Initiatives

- Start Up Loans Programme: Since 2012, this government-backed initiative has provided over £1.1 billion in financing to more than 118,000 early-stage businesses. Notably, businesses supported by this programme have a five-year survival rate of 69%, compared to 43% for comparable businesses without such support.

- Enterprise Investment Scheme (EIS): Celebrating its 30th anniversary, the EIS has facilitated nearly £29.9 billion in investments for over 37,445 enterprises, including notable unicorns like Deliveroo and Revolut. The scheme offers tax reliefs to investors, encouraging investment in high-risk start-ups.

- British Business Bank: This institution plays a pivotal role in financing UK start-ups and SMEs, managing £8 billion and supporting over 206,000 businesses. Its programmes provide debt and equity funding to businesses that struggle to access traditional finance.

Private Incubators and Accelerators

Incubators and accelerators offer mentorship, funding, and networking opportunities for start-ups. Some notable UK incubators include:

- Founders Factory: Supporting over 300 start-ups by providing resources in technology, marketing, and legal matters, alongside corporate partnerships with companies such as Aviva and L’Oréal. Success stories include Tembo Money, co-developed with Founders Factory.

- Tech Nation: Previously a leading accelerator for digital businesses in the UK, Tech Nation has played a crucial role in scaling early-stage ventures, particularly in fintech and AI.

- Barclays Eagle Labs: A bank-led accelerator that provides funding and mentorship to start-ups, particularly in fintech, AI, and green energy.

While these programmes are highly effective, they remain competitive. Success rates for start-ups entering top-tier accelerators range from 2% to 10%, making access a significant hurdle for many entrepreneurs.

Challenges and Disparities

Despite a supportive ecosystem, disparities persist in funding, sector-specific growth, and regional business performance.

Gender Funding Gap

In 2024, only 2% of equity investment went to all-female founder teams, down from 2.5% in 2023. Male-led start-ups, particularly in the AI sector, dominated with over 81% of investment. The lack of diverse investment is a concern, leading to calls for gender-balanced funding initiatives and women-focused investment funds.

Regional Variations

The Start Up Loans programme has been instrumental in supporting businesses outside London and the South East, with 41% of recipients being women and 18% from ethnic minority backgrounds. However, venture capital investment remains disproportionately concentrated in London, with regional start-ups struggling to access similar funding opportunities.

Sector-specific Challenges

- Retail and hospitality: High operational costs and shifting consumer behaviours post-pandemic continue to pose risks for these industries.

- Tech sector: While experiencing high growth, start-ups in AI and fintech face regulatory challenges and talent shortages.

- Sustainability and green technology: A growing area but still struggling with investment compared to traditional industries.

Future Forecasts

Several trends are shaping the future of UK start-ups and SMEs:

- Technological Integration: The rapid advancement of technologies like generative artificial intelligence (GenAI) presents opportunities for start-ups to enhance efficiency and innovation. Companies that adapt to market changes and harness such technologies are poised for growth.

- Investment Landscape: While early-stage funding remains robust, investors are emphasizing clear pathways to profitability. Start-ups may need to demonstrate more solid revenue models and long-term sustainability to secure funding.

- Government Policy Support: Initiatives like the British Growth Partnership aim to channel pension funds into British ventures, reducing reliance on foreign investors and bolstering domestic start-ups.

- Rise of Impact Investment: Investors are increasingly focusing on businesses with social and environmental impact, particularly in sustainability and renewable energy.

- The Evolution of Remote Work: The shift towards hybrid and remote work continues to influence business models, with many start-ups opting for distributed teams over traditional office setups.

Conclusion

The UK’s start-up and SME sectors exhibit resilience amid challenges. With continued support from investment schemes, incubators, and policy initiatives, coupled with a focus on inclusivity and technological adoption, these businesses are well-positioned to drive innovation and economic growth in the coming years. However, addressing funding disparities and ensuring regional business inclusivity will be critical in maintaining a dynamic and thriving entrepreneurial ecosystem.

-

The Rise of Fractional C Level Roles

The UK is experiencing a rapid rise in the use of fractional executives, as businesses seek flexible and cost-effective leadership solutions for key roles such as Chief Financial Officers (CFOs), Chief Marketing Officers (CMOs), Chief Technology Officers (CTOs), and other senior positions. Traditionally, companies relied on full-time executives for strategic leadership, but changing economic conditions, evolving work models, and increasing demand for specialized expertise have driven a shift toward part-time leadership solutions.

This approach allows companies to access high-level strategic input without the long-term financial commitment of hiring full-time executives. Start-ups, scale-ups, and SMEs, in particular, are turning to fractional executives to gain access to experienced leadership at a fraction of the cost, helping them scale operations, attract investment, and navigate complex business challenges.

Why Fractional Roles Are Gaining Traction

Fractional leadership is not a new concept—investment firms have leveraged fractional specialists for years, particularly for due diligence and financial analysis. However, its adoption has accelerated across industries due to several key factors:

- Cost Efficiency – A full-time C-suite executive can command a six-figure salary, plus bonuses, pensions, equity, and other benefits. For businesses with constrained budgets, this can be a significant financial burden. Fractional executives allow companies to pay only for the expertise they need, often at a significantly lower cost, while still benefiting from strategic guidance.

- Specialist Expertise on Demand – Many businesses face complex strategic challenges that require senior-level expertise, but not on a full-time basis. A fractional executive can provide critical leadership for financial planning, marketing strategy, or digital transformation for a few days per month, rather than requiring a permanent role.

- Post-COVID Work Shift – The pandemic caused a fundamental shift in how executives approach work, with many opting for portfolio careers instead of full-time employment. This has expanded the availability of highly skilled professionals who now offer their expertise on a fractional basis, allowing businesses to tap into a wider talent pool.

- Economic Uncertainty & Market Volatility – Given the current economic climate, companies are hesitant to take on long-term financial commitments. Hiring fractional executives allows businesses to remain agile, scaling leadership support up or down based on immediate needs, rather than committing to full-time salaries.

- Technology & Remote Work – Advances in digital collaboration tools have made it easier for executives to work with multiple companies simultaneously. Remote and hybrid work models have removed geographical constraints, allowing companies to hire fractional executives regardless of location.

Full-Time vs. Fractional: The Cost & ROI Factor

The financial argument for fractional executives is compelling. In the UK, a full-time CFO typically earns between £150,000 and £250,000 per year, excluding bonuses and stock options. Add in pensions, benefits, and potential equity stakes, and the cost of hiring a full-time executive can be prohibitive for smaller companies.

By contrast, a fractional CFO might charge £1,500–£3,000 per day, working only a few days per month. This means a business can gain access to high-level financial strategy and leadership for as little as £50,000 per year—potentially saving six figures compared to hiring a full-time executive. Similar cost savings apply to other C-suite roles, making the fractional model highly attractive.

Beyond cost savings, fractional executives often deliver a higher return on investment (ROI). Because they are typically experienced professionals with years of industry knowledge, they can execute faster, avoid costly mistakes, and provide targeted solutions without a lengthy learning curve. This results in more efficient decision-making and quicker strategic execution.

The Future of Fractional Leadership in the UK

The demand for fractional executives is expected to grow significantly in the coming years. Industry forecasts predict that by 2030, up to 30% of all C-suite roles in the UK could be fractional, as businesses continue to embrace flexibility in leadership.

Several industries are leading the charge in adopting this model:

- Tech Start-ups & Scale-ups – Fast-growing companies need expert guidance on finance, marketing, and technology but may not have the capital to afford full-time executives.

- Private Equity & Venture Capital – Investors are increasingly bringing in fractional leaders to provide due diligence, improve portfolio performance, and prepare companies for exits.

- Professional Services & Consulting – Companies in these sectors benefit from having senior leadership available for client-facing roles without long-term overhead costs.

The trend toward fractional leadership is only set to accelerate as businesses seek to remain agile, cost-efficient, and competitive in a rapidly evolving market. Whether for start-ups needing expert guidance, mid-sized businesses looking to optimize operations, or investment firms conducting due diligence, fractional executives are proving to be a powerful solution for driving business success.

#FractionalLeadership #CFO #CMO #CTO #BusinessGrowth #StartupSupport #InvestmentStrategy #PortfolioCareers #FutureOfWork #AgileBusiness #CostEfficiency #ExecutiveHiring #ScaleUp #RemoteWork #LeadershipOnDemand #BusinessStrategy #UKBusiness

-

Leveraging IT for Competitive Advantage and Investment

In the modern business environment, Information Technology (IT) plays a pivotal role not only in driving operational efficiency and innovation but also in fostering investor confidence and attracting funding. Companies that invest strategically in IT tend to outperform their peers, experiencing higher growth, profitability, and resilience in the face of challenges. This, in turn, boosts their attractiveness to investors and lenders. Investors scrutinize IT strategies as a key indicator of a company’s future potential, risk management capabilities, and long-term sustainability.

Key IT Factors That Drive Business Success and Investor Confidence

- IT Maturity & Infrastructure A company’s IT infrastructure is a cornerstone of its ability to scale and innovate. Investors look for businesses that have developed robust IT systems, which are essential for supporting growth and minimizing operational risks.

- Scalable and Resilient Infrastructure: Companies that leverage scalable cloud solutions and implement efficient data management systems are better positioned to reduce costs and expand rapidly. For example, Amazon’s use of cloud infrastructure through Amazon Web Services (AWS) allowed it to scale quickly, contributing significantly to its financial success and making it a magnet for investors. According to McKinsey, firms that migrate to cloud solutions can reduce IT-related costs by up to 40%.

- Automation & Efficiency: The implementation of AI, machine learning, and automation technologies allows businesses to streamline operations, reduce costs, and enhance productivity. Companies such as UiPath, a leader in robotic process automation (RPA), have demonstrated how automation can lead to both operational efficiency and competitive advantage, resulting in strong investor backing and a successful IPO.

- IT Governance & Compliance: Investors seek companies with strong IT governance structures and risk management frameworks in place. Firms that adhere to industry standards such as ISO 27001 and ITIL show commitment to securing their operations and managing risks effectively, which boosts investor confidence.

- Innovation & Competitive Edge IT is a critical enabler of innovation, helping companies differentiate their products and services, enhance customer experiences, and remain adaptable in dynamic markets. Companies that harness technology to innovate are seen as more likely to capture market share and grow sustainably, attracting investors eager to back future-forward businesses.

- Product Differentiation: Companies that incorporate cutting-edge technologies such as artificial intelligence, blockchain, and the Internet of Things (IoT) can create unique products that stand out in competitive markets. Tesla, for example, has used AI and IoT to revolutionize the automotive industry with self-driving technology, significantly increasing its market valuation and boosting investor confidence.

- Digital Transformation: Businesses investing in digital transformation initiatives—whether through improving user interfaces, adopting cloud-based platforms, or modernizing internal processes—tend to achieve improved customer satisfaction and operational agility. Microsoft’s successful pivot to a cloud-first strategy has seen its market value rise sharply, with cloud revenue growing more than 30% year-over-year.

- Scalability & Market Agility: Investors favor companies with IT infrastructures that allow for quick scaling and adaptability. For instance, Netflix’s use of cloud-based services to scale its content delivery network during periods of high demand helped it maintain a competitive edge in the streaming market, while increasing investor trust and enhancing its growth trajectory.

- Cybersecurity & Risk Management As cyber threats become more frequent and sophisticated, robust cybersecurity measures are a top priority for investors and lenders. A company that demonstrates a proactive approach to managing digital risk can secure greater confidence from potential investors and lenders.

- Cybersecurity Frameworks: A well-established cybersecurity posture, including adherence to best practices and industry standards like ISO 27001 and Cyber Essentials, reduces the likelihood of cyberattacks and enhances investor trust. Businesses with solid cybersecurity frameworks mitigate the risk of costly breaches and regulatory penalties, as evidenced by the 2020 British Airways breach, which resulted in a £20 million fine for poor data protection.

- Compliance & Legal Protection: Investors also look for companies that comply with industry regulations such as GDPR, especially in sectors like finance and healthcare. Non-compliance can lead to regulatory fines and legal risks, which harm both a company’s reputation and financial stability. Companies with strong compliance records are more likely to secure funding at favorable terms.

- Data Protection & Incident Response Plans: Investors want assurance that a company can manage data breaches or IT disasters effectively. A well-established incident response plan and historical track record of addressing security issues proactively provide reassurance that the company can weather cyber threats without substantial financial setbacks.

The Role of IT in Investor Confidence and Lending

Investors and lenders are more inclined to support companies that demonstrate a robust IT strategy, as it indicates financial stability, growth potential, and operational resilience. IT investments have a direct correlation with financial success, as companies that adopt modern technologies can improve profitability and productivity while lowering costs.

- Investor Confidence: Companies that prioritize IT investments tend to attract higher levels of investor interest. The reason is simple: robust IT capabilities indicate the ability to manage operations efficiently, innovate, and respond to market shifts. For example, Apple, a company that has consistently invested in both hardware and software innovation, boasts a market capitalization of over $2.5 trillion, supported by a loyal investor base.

- Attracting Funding: Lenders, particularly venture capitalists (VCs) and private equity firms, favor companies that show a clear alignment between IT strategy and business objectives. Strong IT infrastructure, digital transformation, and cybersecurity protocols all point to a lower-risk investment, making companies with these attributes more likely to secure loans or funding at favorable terms. For instance, Salesforce, by focusing heavily on cloud solutions and customer relationship management (CRM) software, not only attracted significant early-stage investment but also grew into one of the world’s largest enterprise software companies.

In-House IT vs. Outsourcing to a Managed Service Provider (MSP)

Investor confidence is also affected by how a company manages its IT operations—whether in-house or through outsourcing to a Managed Service Provider (MSP).

In-House IT

- Pros:

- More control over IT operations and security measures.

- Custom solutions tailored specifically to business needs.

- Closer alignment with company strategy and operations.

- Cons:

- High operational costs related to recruitment, training, and retaining IT talent.

- Risk of limited expertise in specialized fields like cybersecurity or cloud management.

- Potential scalability issues as the company expands.

Managed Service Provider (MSP)

- Pros:

- Access to specialized expertise, including cybersecurity, cloud management, and IT support.

- Cost-effectiveness, especially for smaller companies that cannot afford large in-house teams.

- Scalability and flexibility to adjust IT services as the business grows.

- Cons:

- Reduced control over IT operations, potentially leading to misalignments with business needs.

- Dependence on the MSP’s reliability and responsiveness.

- Potential security risks if the MSP does not follow best practices or fails to meet SLAs (Service Level Agreements).

Market Statistics and Examples of IT-Driven Success

Numerous companies have demonstrated how strategic IT investments can drive both business success and investor confidence. For example, Google’s continued investment in machine learning and AI technologies has not only helped it dominate the digital advertising market but also cemented its position as one of the world’s most trusted brands for investors.

Similarly, Shopify’s aggressive push to enhance its e-commerce platform using advanced cloud services has resulted in a significant increase in revenue, attracting both venture capital investment and retail partners. Shopify’s stock price rose by over 170% from 2019 to 2021, thanks to its strong IT-driven market position.

On the other hand, companies that have not embraced IT innovation or lacked strong IT governance have faced challenges. Blockbuster, which failed to invest in digital transformation, ultimately lost its market leadership to Netflix, which utilized cloud technology and advanced data analytics to deliver superior customer experiences.

Conclusion

The integration of robust IT strategies is integral to both business success and the ability to attract investment. Companies that invest in scalable infrastructure, innovation, and cybersecurity often see higher growth, enhanced investor confidence, and greater success in securing funding. As IT continues to shape industries worldwide, businesses that effectively leverage these technologies will stand out as leaders in their sectors, making them highly attractive to investors and lenders alike.

#InformationTechnology #InvestorConfidence #BusinessSuccess #ITStrategy #DigitalTransformation #CloudComputing #Automation #AI #Cybersecurity #VentureCapital #InvestmentAttraction #TechInnovation #ScalableBusiness #InvestorAttraction #CloudServices #TechInvestment #BusinessGrowth #FinancialSuccess

- IT Maturity & Infrastructure A company’s IT infrastructure is a cornerstone of its ability to scale and innovate. Investors look for businesses that have developed robust IT systems, which are essential for supporting growth and minimizing operational risks.

-

Business Insurance

Introduction

Insurance is a fundamental part of risk management for businesses of all sizes. From start-ups to well-established enterprises, having the right coverage can mean the difference between financial stability and catastrophic loss. This article explores essential insurance policies, key market statistics, and real-world examples where a lack of coverage led to disaster. It also delves into the importance of cyber insurance, particularly in light of regulatory frameworks like Cyber Essentials, NIS2, and the role of the Information Commissioner’s Office (ICO) in enforcing compliance.

Key Types of Business Insurance

- Business Interruption Insurance

- Covers loss of income due to unforeseen disruptions like natural disasters, fires, or supply chain failures.

- Example: During the COVID-19 pandemic, many businesses without business interruption insurance faced significant financial distress due to lockdowns.

- Cyber Insurance

- Protects against financial losses from cyberattacks, data breaches, and ransomware incidents.

- Given the rise in cybercrime, cyber insurance has become a necessity, particularly for businesses handling sensitive customer data.

- Directors & Officers (D&O) Insurance

- Protects company executives from personal financial liability due to decisions made in their professional roles.

- Example: In cases like the collapse of Carillion, where directors were scrutinized for their roles in mismanagement, D&O insurance can help cover legal defense costs.

- Professional Indemnity Insurance

- Covers legal costs and claims for damages due to inadequate advice, services, or designs provided to clients.

- Essential for consultants, law firms, and IT professionals.

- Employers’ Liability Insurance (Legal Requirement in the UK)

- Mandatory for businesses with employees to cover claims for work-related injuries or illnesses.

- Public Liability Insurance

- Covers claims from third parties for injuries or property damage caused by business activities.

The Growing Importance of Cyber Insurance

Cyber threats have escalated significantly, with UK businesses facing increased ransomware attacks, phishing scams, and data breaches. According to the UK Government’s 2023 Cyber Security Breaches Survey:

- 32% of businesses reported a cyber breach or attack in the past 12 months.

- The average cost of a cyber breach for medium and large businesses was over £19,400.

UK Government Cybersecurity Regulations

To enhance cybersecurity resilience, the UK government has introduced several frameworks:

Cyber Essentials

- A government-backed certification that helps businesses implement basic cybersecurity measures.

- Reduces the risk of common cyber threats by up to 80%.

- Essential for companies bidding for government contracts.

Network and Information Systems Directive 2 (NIS2)

- Expands the scope of cybersecurity regulations to more industries, including healthcare, finance, and digital services.

- Introduces stricter security measures and penalties for non-compliance.

- Companies must implement risk management policies and report cybersecurity incidents to regulators.

The Role of the ICO and Data Protection Fines

The Information Commissioner’s Office (ICO) enforces data protection laws under the UK GDPR and the Data Protection Act 2018. Companies failing to protect customer data can face severe penalties.

Notable ICO Fines:

- British Airways (2019): Fined £20 million after hackers stole the personal and financial details of 400,000 customers.

- Marriott International (2020): Fined £18.4 million for failing to protect customer data in a breach affecting 339 million guests.

- Ticketmaster UK (2020): Fined £1.25 million for failing to prevent a cyberattack that compromised payment details.

Businesses without cyber insurance often struggle to manage the financial and reputational damage resulting from such breaches. Cyber insurance policies can cover:

- Incident response costs (forensic investigations, legal fees, and PR expenses).

- Ransomware payments.

- Compensation claims from affected customers.

The Risks of Not Having Adequate Insurance

Several businesses have suffered catastrophic losses due to inadequate insurance coverage. Some examples include:

- Thomas Cook (2019): The company’s collapse resulted in massive financial losses, partly due to insufficient D&O coverage for legal claims.

- Sony (2011): A cyberattack on PlayStation Network led to the exposure of 77 million user accounts. Sony initially lacked cyber insurance, leading to estimated losses exceeding $170 million.

Conclusion

Businesses, whether start-ups or established enterprises, must prioritize the right insurance coverage to mitigate risks. Business interruption, cyber, and D&O insurance are particularly crucial in today’s landscape of cyber threats and regulatory scrutiny. With frameworks like Cyber Essentials and NIS2 in place, businesses must stay compliant to avoid hefty ICO fines and reputational damage.

#BusinessInsurance #CyberSecurity #ICOFines #CyberEssentials #NIS2 #RiskManagement

- Business Interruption Insurance

-

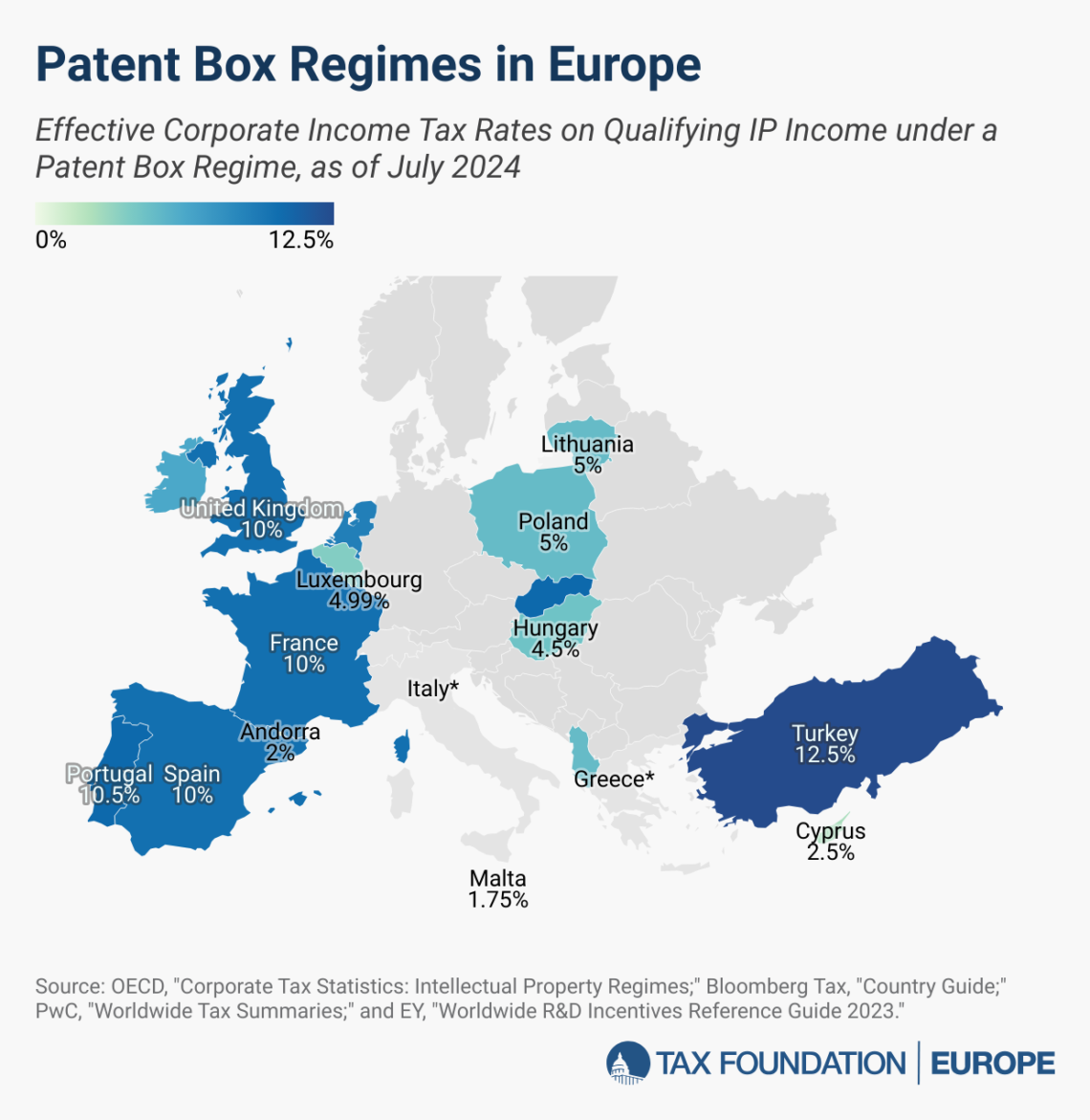

The UK Patent Box Tax Scheme: Keeping Intellectual Property on Home Soil

The UK Patent Box is a tax incentive designed to encourage companies to keep and commercialise their intellectual property (IP) within the UK. By offering a reduced corporation tax rate of 10% on qualifying profits derived from patented inventions, the scheme aims to make the UK an attractive hub for innovation and investment. But how does it work, and what are the alternatives?

How the UK Patent Box Works

The Patent Box scheme applies to companies that own or exclusively license patents granted by the UK Intellectual Property Office (IPO), the European Patent Office (EPO), or certain other qualifying jurisdictions. To benefit, businesses must:

- Be liable for UK Corporation Tax

- Have developed the patented innovation or made significant improvements to it

- Elect into the scheme within two years from the end of the relevant accounting period

Once approved, profits directly attributable to the patented technology benefit from a 10% corporation tax rate, significantly lower than the UK’s 25% main rate.

Why the UK Encourages Companies to Retain IP Onshore

Many multinational corporations shift IP offshore to jurisdictions with lower tax rates, but the UK government has designed incentives like the Patent Box and R&D Tax Credits to keep IP within the UK. The primary reasons include:

1. Tax Revenue Retention

When companies register and exploit their IP within the UK, the government collects corporate tax, employment tax, and VAT associated with commercial activities. Keeping IP onshore ensures that profits remain within the UK tax net.

2. Innovation and Job Creation

A strong domestic IP ecosystem leads to greater R&D investment, job creation, and knowledge transfer between universities, businesses, and research institutions.

3. Compliance with OECD BEPS Rules

The OECD’s Base Erosion and Profit Shifting (BEPS) project discourages profit shifting to tax havens. The UK Patent Box is designed to comply with these regulations while maintaining a competitive tax structure.

Alternative UK Incentives for IP-Driven Businesses

In addition to the Patent Box, UK businesses can benefit from:

1. R&D Tax Credits

- SMEs can claim up to 186% of qualifying R&D expenditure as a tax deduction.

- Large companies can use the R&D Expenditure Credit (RDEC), offering a 20% credit on eligible R&D spending.

2. Enterprise Investment Scheme (EIS) & Seed Enterprise Investment Scheme (SEIS)

- EIS: Investors receive 30% income tax relief on investments in qualifying high-growth UK companies.

- SEIS: Offers 50% tax relief on investments in very early-stage businesses.

3. Innovate UK Grants

- Direct funding for companies developing cutting-edge technology and innovation in sectors like biotech, AI, and clean energy.

The Offshore IP Strategy: Pros & Cons

Some companies establish offshore IP holding structures in low-tax jurisdictions like Ireland, Luxembourg, or the Cayman Islands. While this can offer financial benefits, there are key considerations:

✅ Pros of Offshore IP Holding

- Lower Tax Rates: Some jurisdictions offer 0%-12.5% corporate tax rates.

- Global IP Management: Allows businesses to centralise IP across multiple markets.

- Flexibility in Licensing & Royalties: Potential for cross-border licensing to reduce tax burdens.

❌ Cons of Offshore IP Holding

- OECD & HMRC Scrutiny: BEPS rules mean that IP must be substantively developed in the offshore jurisdiction, making it harder to justify tax advantages.

- Loss of UK Patent Box Benefits: UK companies using offshore IP structures may lose access to the 10% Patent Box rate.

- Repatriation Costs: Bringing IP back to the UK later may result in capital gains tax and legal restructuring costs.

Conclusion: Should You Use the UK Patent Box or Go Offshore?

For most UK companies, keeping IP onshore and leveraging Patent Box, R&D tax relief, and UK grants offers a secure and compliant tax strategy. While offshore IP structures can provide savings, they come with increased regulatory risks and potential reputational damage.

By carefully assessing long-term tax efficiency, compliance obligations, and commercial strategy, businesses can determine the best approach to managing their intellectual property.

#UKPatentBox #IntellectualProperty #TaxIncentives #Innovation #BusinessGrowth #RDTaxCredits #UKBusiness #IPTax #OffshoreTax #Startups #TechInvesting

-

Understanding Intellectual Property (IP): Patents, Trade Secrets, Copyright, and Trademarks

Intellectual Property (IP) is an umbrella term for various legal protections granted to individuals or organizations for their creations, ideas, and innovations. The purpose of IP is to foster innovation, reward creators, and protect the original works that contribute to economic and cultural development. IP can take several forms, each with its unique characteristics, including patents, trade secrets, copyrights, and trademarks. In this article, we’ll explore each form of IP, compare and contrast them, and delve into the costs of defending, setting them up, and the considerations of simply using them.

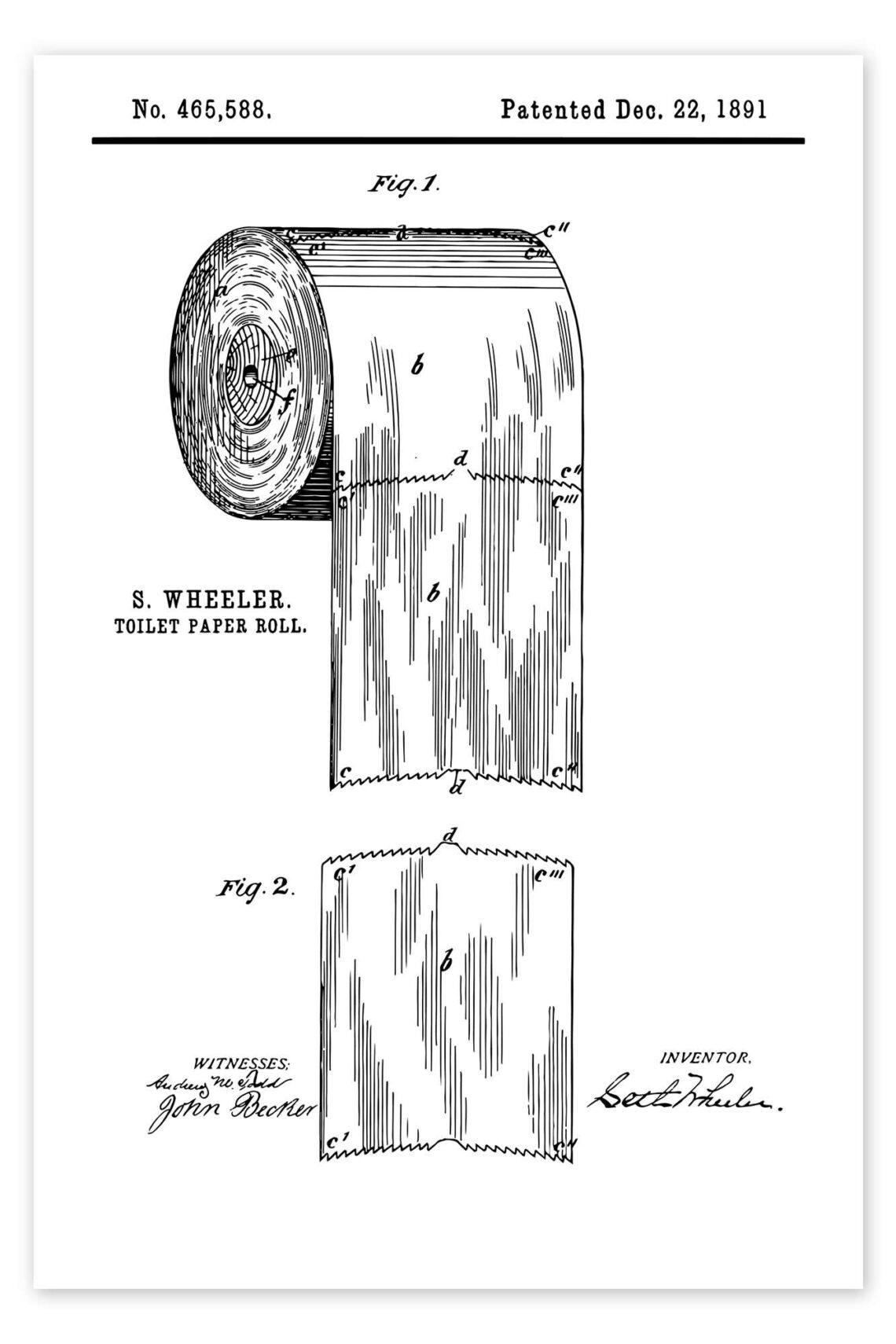

1. Patents: Protecting Innovations

A patent is a legal right granted to an inventor, giving them exclusive rights to a particular invention or process for a limited time, typically 20 years from the application date. This prevents others from making, using, or selling the patented invention without permission.

Costs of Setting Up and Defending:

- Setting Up: Filing a patent can be expensive, particularly if you hire a patent attorney for a complex invention. Filing fees can range from a few hundred to several thousand dollars, depending on the jurisdiction. Patents must also be thoroughly researched to ensure they are novel and non-obvious, a task that can take time and incur costs.

- Defending: If someone infringes on your patent, defending it can be costly, often requiring litigation. Patent lawsuits can run into the hundreds of thousands of dollars, even for relatively straightforward cases.

Using Patents:

- Using a patented invention without permission is illegal and can result in significant fines and damages. However, acquiring a patent license from the holder allows for lawful use, though licensing agreements can be expensive.

2. Trade Secrets: Confidential Business Information

A trade secret refers to valuable business information that is kept confidential to maintain a competitive edge. This could include formulas, practices, designs, or processes. The famous Coca-Cola formula is one of the most well-known examples of a trade secret. The validity of a trade secret isn’t tied to a specific period of time, unlike patents or copyrights. Instead, a trade secret remains legally protected as long as it fulfills certain conditions:

- It provides a competitive advantage because it is not generally known to the public.

- Reasonable measures are taken to keep it secret, such as confidentiality agreements or restricted access.

If the secret is disclosed or independently discovered, the protection ends. This indefinite nature of trade secrets can be both an advantage and a risk compared to other intellectual property protections.

Costs of Setting Up and Defending:

- Setting Up: The cost of setting up a trade secret is relatively low since there are no official filings or registrations required. The focus is on internal controls and non-disclosure agreements (NDAs) to protect the secret.

- Defending: Defending a trade secret can be complicated if it is disclosed or stolen. Legal costs are often linked to proving that the secret was protected adequately and that the disclosure was unlawful. This could involve expensive litigation if the case escalates.

Using Trade Secrets:

- Using a trade secret without permission is a breach of trust, and if discovered, it could result in legal action. However, trade secrets can be lawfully used if obtained through legitimate means, such as reverse engineering.

3. Copyright: Protecting Creative Works

Copyright protects original works of authorship, such as literary, musical, and artistic creations. Copyright automatically applies once the work is created and fixed in a tangible medium of expression (e.g., written on paper, recorded on video).

Costs of Setting Up and Defending:

- Setting Up: Copyright registration is optional in many jurisdictions but can be beneficial in legal disputes. The cost of registering a copyright is relatively low, often under $100.

- Defending: Defending a copyright is typically less expensive than patents but can still incur significant legal fees. Copyright infringement cases can lead to damages, and enforcement may require costly legal action.

Using Copyright:

- Using copyrighted works without permission is considered infringement. To use a copyrighted work, one typically needs to obtain permission, often in the form of a license.

4. Trademarks: Protecting Brand Identity

A trademark is a symbol, word, or phrase legally registered to represent a company or product. Trademarks protect brands and distinguish goods or services in the marketplace.

Costs of Setting Up and Defending:

- Setting Up: Trademark registration is relatively affordable, with costs ranging from a few hundred dollars to over a thousand, depending on the complexity and number of jurisdictions. You can file for a trademark on your own, though it’s often recommended to consult an attorney.

- Defending: Enforcing a trademark involves monitoring potential infringements and taking legal action when necessary. While trademark defense is often less expensive than patent defense, it can still lead to significant legal costs, especially if the case escalates.

Using Trademarks:

- Using a trademark without authorization constitutes infringement. However, it’s possible to use a trademarked term or logo in certain contexts, such as comparative advertising, as long as it doesn’t cause confusion or imply endorsement.

Comparing the Costs of Setting Up vs. Using IP

IP Type Setting Up Costs Defending Costs Using Without Permission Patents Expensive (filing fees, attorney fees) High (patent litigation can be costly) Illegal, could lead to lawsuits and damages Trade Secrets Low (no registration required) Moderate to high (depends on legal action needed) Illegal if acquired through improper means Copyrights Low to moderate (registration fees) Moderate (copyright infringement lawsuits) Illegal, requires permission or license Trademarks Moderate (registration fees) Moderate (costs for enforcing trademark rights) Illegal, requires permission or license Conclusion: Should You Protect or Use IP?

Whether you should protect your intellectual property or simply use someone else’s IP depends on your business model and goals. Setting up IP protection—such as patents or trademarks—can provide exclusive rights, preventing others from capitalizing on your ideas and innovations. However, the costs of setting up and defending IP can be substantial, especially for small businesses or startups.

On the other hand, using existing IP by obtaining licenses or permissions can be more cost-effective in the short term, but it may limit your ability to control the use of your ideas or brand identity. Businesses must weigh the cost of establishing and defending their IP against the risk of legal consequences for unauthorized use.

Final Thoughts

The decision to protect, use, or license intellectual property should be made carefully, with consideration of the associated costs and legal risks. Understanding the nuances of patents, trade secrets, copyrights, and trademarks is essential for any business or individual navigating the modern economy.

#IntellectualProperty #Patents #Trademarks #Copyright #TradeSecrets #IPProtection #BusinessStrategy #Innovation #LegalRisks #IntellectualPropertyLawAttach

-

Kognise welcomes Georgina Chapman

We are delighted to formally welcome Georgina Chapman as a partner at Kognise Ltd. Georgina brings an impressive breadth of experience and expertise that will undoubtedly enrich our firm and its future endeavours.

Georgina possesses an extensive and influential network, is a proven leader across both the Not-for-Profit (NFP) and For-Profit (FP) sectors, with a deep understanding of organisational dynamics and strategy. She has specialist skills in working with High-Net-Worth Individuals (HNWI), providing tailored insights and strategic engagement. She has incredible organisational abilities and a distinguished track record as a project manager, ensuring precision and efficiency in all endeavours.

Outside of work Georgina is an accomplished equestrian, having owned and retrained racehorses, Georgina has cultivated an extensive network within the equestrian community, including breeding and performance expertise.

A Message from Anthony Keith King, Founder of Kognise Ltd: “It is with immense pride and excitement that I welcome Georgina to Kognise Ltd as a partner. Her unique expertise, remarkable organisational skills, and broad network are an excellent fit for our firm’s vision and values. Her passion for connecting people and creating opportunities aligns perfectly with what we stand for, and I have no doubt she will play a vital role in driving us forward. Georgina, welcome to the team—it’s an honour to have you on board!”

-

Family Offices

Family offices are private wealth management entities established to oversee the financial and personal affairs of ultra-high-net-worth individuals (UHNWIs) and their families. They offer a bespoke range of services, including investment management, tax planning, estate management, philanthropy coordination, and even lifestyle services. The primary goal of a family office is to preserve and grow the wealth of a family across generations while meeting their unique needs and values.

There are two main types of family offices:

- Single-Family Offices (SFOs): These serve one family exclusively, providing fully personalized services. They are often created by families with significant wealth and require considerable resources to operate.

- Multi-Family Offices (MFOs): These manage the wealth of multiple families, allowing for cost-sharing and access to a broader range of expertise. MFOs are ideal for families who seek comprehensive services but do not have the scale or desire to establish their own office.

Current State of Family Office Funds

The number of family offices globally has surged, with an estimated 8,030 single-family offices in 2024, projected to reach 10,720 by 2030. This growth reflects the increasing wealth among UHNWIs and the demand for tailored financial solutions.

Family offices have become more professionalized in recent years. Over half have established formal investment committees and clearly defined policy statements. Governance practices are improving, with 70% implementing performance review processes. Many offices are also separating operations from family businesses to enhance efficiency and focus on core objectives.

Investment Trends and Market Statistics

Family offices continue to lean heavily into private markets, particularly private equity, which remains the most favored asset class. On average, family offices allocate 22% of their portfolios to private equity, followed by unlisted real estate and venture capital. Approximately 89% of family offices invest in venture capital, reflecting a growing appetite for high-growth opportunities.

Impact investing, particularly in sectors like renewable energy, healthcare, and education, is gaining momentum. Nearly 35% of family offices have integrated environmental, social, and governance (ESG) factors into their investment decisions, aligning with global sustainability goals.

Key market data includes:

- Private Equity: Over 50% of family offices increased their allocations to private equity in 2024-25.

- Real Estate: 33% boosted investments in unlisted real estate, focusing on sustainable and commercial properties.

- Venture Capital: Technology and AI-focused venture funds have been top recipients, with 60% of family offices citing strong opportunities in these areas.

Notable Named Examples

- Walton Enterprises LLC: The family office of the Walton family, owners of Walmart, manages assets exceeding $225 billion. It focuses on diversified investments, including private equity and philanthropy.

- Cascade Investment: Established by Bill Gates, this family office manages over $170 billion in assets, with significant investments in real estate, energy, and technology.

- Bezos Expeditions: Jeff Bezos’ family office oversees investments in venture capital, including high-profile startups like Airbnb and Uber, as well as philanthropic initiatives.

- Pontegadea Inversiones: Owned by Amancio Ortega, founder of Zara, this family office manages over $54 billion, with a focus on real estate and retail investments.

- Soros Family Office: Founded by George Soros, this office manages approximately $30 billion, with a strong emphasis on impact investing and global markets.

Forecast for 2025 and Beyond

The outlook for family office investments is bright, with key trends shaping the future:

- Technological Innovation: AI and digital transformation are transforming the investment landscape. Family offices are leveraging AI to optimize portfolios, manage risk, and improve decision-making.

- Sustainability and Impact Investing: ESG principles are increasingly embedded in strategies, with families prioritizing investments that align with their values and contribute to global challenges such as climate change.

- Diversification: Alternative investments, including private equity, venture capital, and sustainable real estate, will see growing allocations as families look to balance risk and reward.

- Global Opportunities: Emerging markets, particularly in Asia and Latin America, offer diversification benefits and significant growth potential. Family offices are increasingly targeting these regions for investment.

Conclusion

Family offices are redefining wealth management through professionalization, diversification, and a commitment to innovation. By aligning portfolios with technological advances, sustainability goals, and global growth opportunities, they are well-positioned to navigate the complexities of the financial landscape in 2025 and beyond. Their influence in shaping future investment trends will undoubtedly remain strong as they continue to set the benchmark for personalized, multi-generational wealth management.

-

The Current State and Future of the UK Construction Industry

The UK construction industry is currently navigating a challenging landscape, marked by a mix of setbacks and opportunities. As of early 2025, the sector has experienced a slowdown, with construction output hitting a five-year low in February. This decline has been driven by weak demand, rising borrowing costs, and a lack of new projects to replace completed ones. Residential construction has been particularly hard-hit, with activity decreasing for the fifth consecutive month. However, commercial construction has shown resilience, maintaining relatively stable levels of activity.

The industry is also grappling with persistent issues such as labour shortages and rising costs. An estimated 225,000 new construction workers are needed by 2027 to meet demand. Additionally, outdated financial models and payment delays have created cash flow challenges, particularly for small and medium-sized enterprises. These challenges underscore the need for systemic reform, with calls for streamlined payment processes and incentives to attract skilled workers into the industry.

Investment Outlook

Despite these hurdles, the outlook for investment in the UK construction industry is cautiously optimistic. Increased government funding is expected to play a pivotal role in driving growth, particularly in infrastructure and renewable energy projects. The sector is also set to benefit from strategic fiscal changes, which will unlock significant public sector and infrastructure projects over the next two years. Private sector investment is anticipated to rise as consumer and business confidence improves, with an 8% boost in project starts forecast for 2025 and a further 10% increase in 2026.

Several high-profile projects are on the horizon, including expansions in the transport and renewable energy sectors. For instance, large-scale wind farms, solar energy installations, and improvements to rail networks are expected to draw significant investments. These projects align with the UK’s commitment to achieving net-zero carbon emissions by 2050, further bolstering confidence in the sector’s long-term prospects.

Digital transformation and sustainability initiatives are also attracting investment. Technologies like AI, robotics, and Building Information Modelling (BIM) are reshaping the industry, making it more efficient and appealing to investors. Additionally, the focus on renewable energy and sustainable construction practices is expected to drive further funding into the sector. The embrace of modern methods of construction (MMC), such as modular building, is another area where investment is expected to grow, offering faster project delivery times and lower environmental impact.

Future Prospects

Looking ahead, the forecast for the UK construction industry is cautiously optimistic. Growth is expected to resume from 2025, supported by falling interest rates and increased investments in infrastructure and commercial projects. The Construction Skills Network predicts that an additional 251,500 workers will be required by 2028 to meet the anticipated growth.

Efforts to address labour shortages are beginning to show promise, with apprenticeships and training programs receiving increased funding. The government and industry bodies are collaborating to attract a younger, more diverse workforce to ensure the sector can meet future demands. Additionally, regulatory adjustments aimed at simplifying planning processes are anticipated to accelerate project approvals and boost investment.

However, challenges such as labour shortages, regulatory compliance, and material costs will need to be addressed to fully capitalize on these opportunities. The industry must also adapt to changing market conditions, such as the increasing importance of energy-efficient buildings and the integration of smart technologies into construction.

In summary, while the UK construction industry faces significant challenges, its resilience and adaptability offer hope for a brighter future. With strategic investments, a focus on innovation, and concerted efforts to resolve existing issues, the sector is poised to overcome its current difficulties and achieve sustainable growth in the coming years. The next decade could mark a transformative period for construction in the UK, with innovation and sustainability leading the way.

#UKConstruction #ConstructionIndustry #FutureOfConstruction #SustainableBuilding #InfrastructureInvestment #DigitalTransformation #ModernConstruction #RenewableEnergyProjects #ConstructionInnovation #BuildBritain #ConstructionGrowth #SmartBuilding #UKInfrastructure #NetZeroGoals #ConstructionResilience