UK Tech in 2024

The below includes some of the key takeaways from our recent report on the state of UK tech heading into 2024, the current health of the ecosystem through a venture capital, geographic and sectoral lens, with HSBC Innovation Banking.

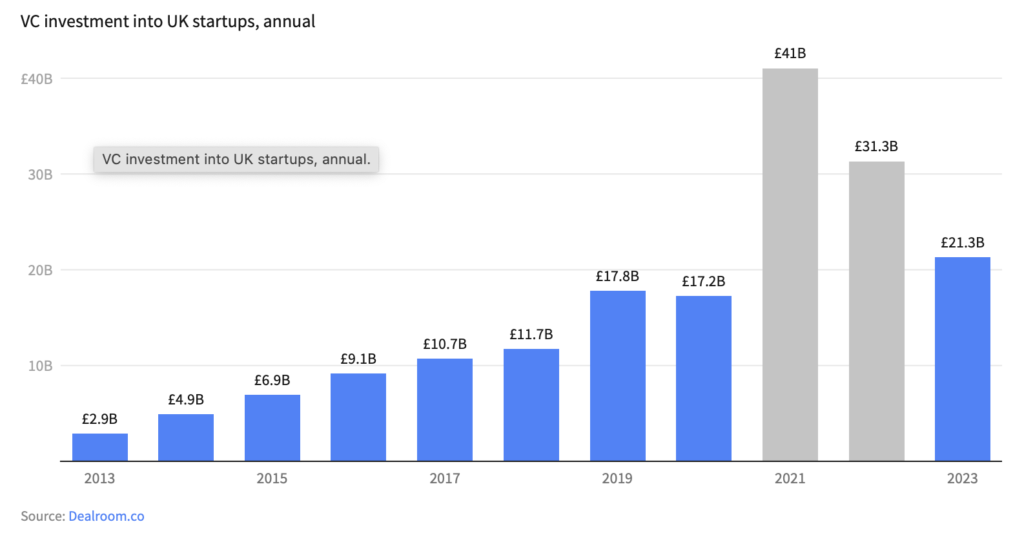

Venture capital in the UK reached an all-time high in 2023 (if you exclude the outlier years of 2021 & 2022).

UK start-ups raised $21.3B in 2023, the third highest total on record, after just the outlier years of 2021/22.

- VC investment has been growing again as of H2 2023.

- Investment up 46% in the second half of 2023, compared to the period Jan-Jun.

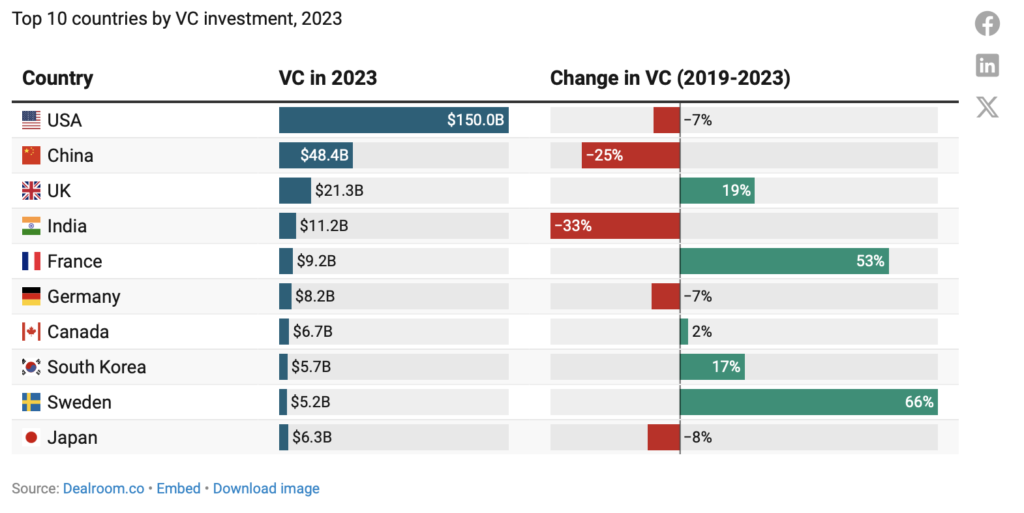

- UK remains the #3 tech ecosystem in the world, 1st in Europe.

UK remains the #3 tech ecosystem in the world, only behind the US and China.

However, on the European scene, UK start-ups raised more than 2nd and 3rd placed France and German start-ups combined.

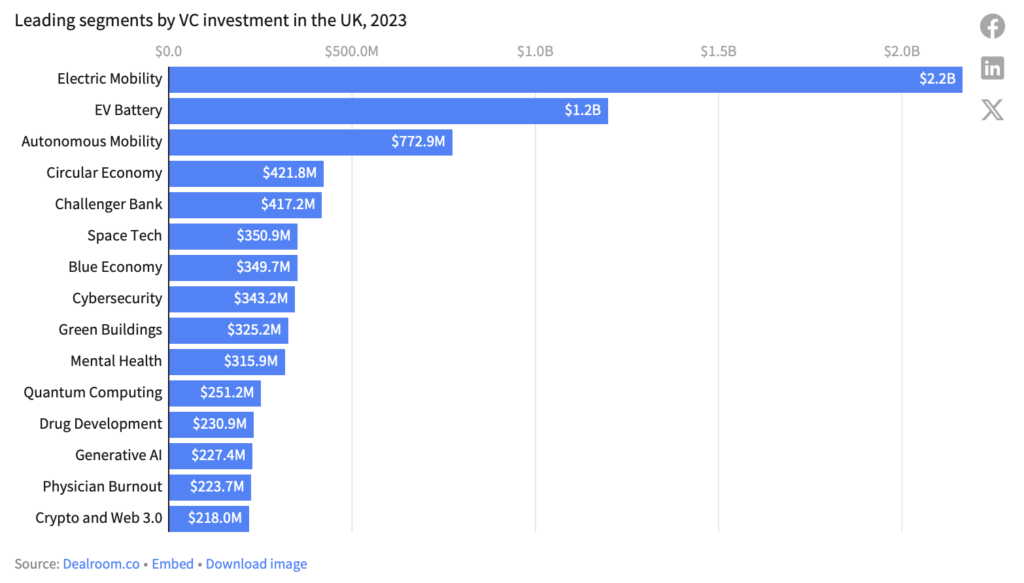

AI and Climate tech are the UK hottest startup segments.

- Benchmark the UK ecosystem by VC investment, unicorns, new funds as well as other metrics against its European and Global counterparts here on the platform.

- Electric mobility, EV battery tech and Autonomous mobility were the top funded UK start-up segments in 2023.

- Climate tech accounted for 29% of all UK VC investment in 2023 – $6.2B, an all-time high. This represented 40% growth year on year.

- Start-ups utilising AI raised $4.5B in investment in 2023, including significant rounds for Generative AI companies Synthesia ($90M), AutogenAI ($22.3M & $39.5M) and Stability AI ($50M).

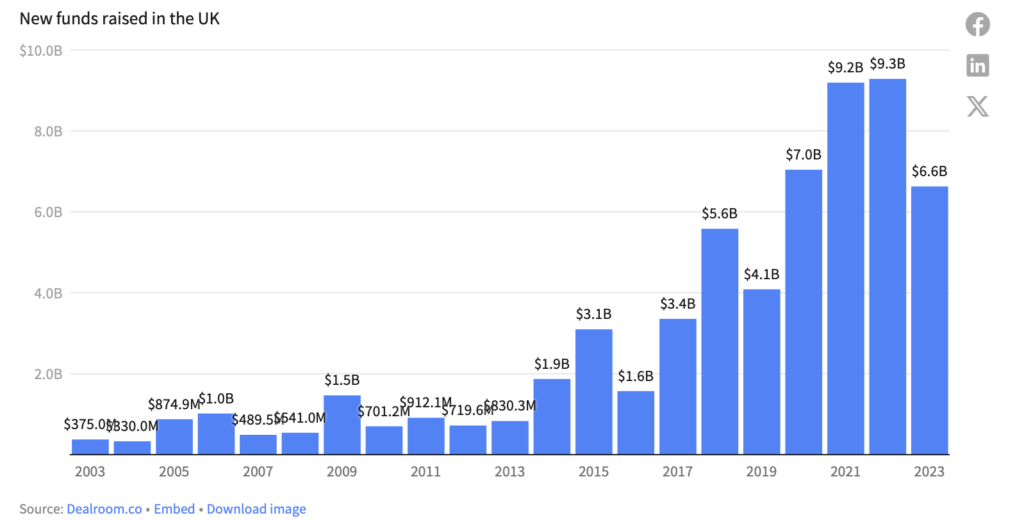

UK investors are armed with over $25B new funds raised in the last 3 years

Over $25B raised in the last three years in the UK.

Leading UK funds are freshly equipped to deploy in 2024.

The UK is the home of European venture capital with 40% of new European VC capital raised in the last five years being based in the UK.